SenseTime IPO success rests on overseas investors

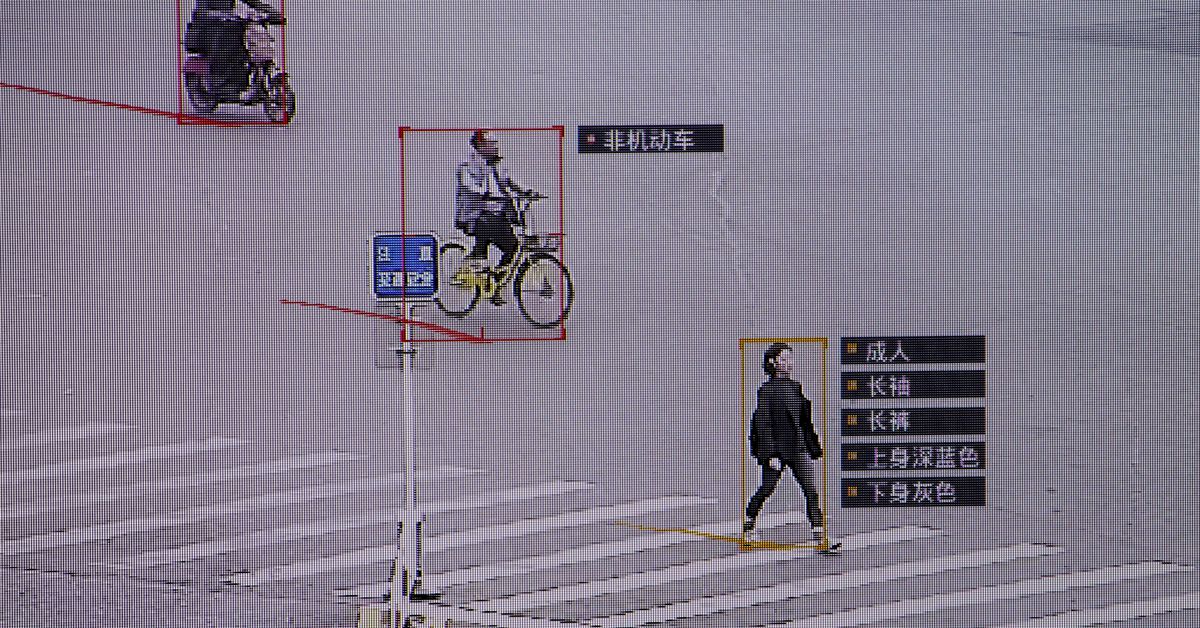

SenseTime surveillance software identifying details about people and vehicles runs as a demonstration at the company’s office in Beijing, China, October 11, 2017. Picture taken October 11, 2017. REUTERS/Thomas Peter – RC1D27EF3190

HONG KONG, Sept 9 (Reuters Breakingviews) – Artificial intelligence has delivered as much in controversy as it has for investors. Nowhere does that hold truer than for China’s AI “dragons”, the largest of which, SenseTime, is now seeking a Hong Kong initial public offering. It wants to raise as much as $2 billion, according to media reports. If regulators sign off, its biggest test will be overcoming its position on a U.S. trade blacklist to attract international backing.

Seven-year-old SenseTime, which counts SoftBank’s (9984.T) Vision Fund and Alibaba (9988.HK) among its backers, was valued at $10 billion in a 2020 funding round. It specialises in image recognition software used by city authorities and in smartphone cameras and self-driving vehicles. Its technology is also useful in the metaverse, which promises to mix reality and a virtual world.

Assuming first-half revenue increases at the same pace for the rest of the year, its compound annual growth rate since 2018 would be 21%. Research, sales and administrative costs have been rising faster. Still, unprofitable U.S. AI-related companies such as $50 billion Palantir (PLTR.N) or $90 billion Snowflake (SNOW.N) have outperformed the Nasdaq Composite Index over the past three months.

The big issue though for foreign investors is social governance. SenseTime sold its holding in a company focused on Xinjiang in March 2019 but was still added to the U.S. “entity” list in October that year along with three other AI dragons for its perceived involvement in Beijing’s repressive treatment and surveillance of minority Muslim groups in the province. The U.S. blacklist, which applies to components, has had no material impact on SenseTime’s software-dominated business. The company established an ethics council in 2019, too. Yet the fact remains that its cutting-edge technology could be used by bad actors.

Listing may not be easy. Compatriot Megvii let its Hong Kong IPO application lapse in February 2020 after failing to win approval while AI chipmaker Yitu Technology in March dropped plans to go public in Shanghai. HSBC’s (HSBA.L), (0005.HK) presence as a sponsor of SenseTime’s deal suggests the company is serious about wanting international backing. A broadly backed share sale would suggest that foreign investors are less concerned about Chinese technology than many governments are.

Follow @JennHughes13 on Twitter

CONTEXT NEWS

– Chinese artificial intelligence start-up SenseTime on Aug. 26 filed for a Hong Kong initial public offering. The group, which specialises in image recognition for cities and autonomous driving among other applications, did not specify a fundraising target, but previous media reports have suggested it is seeking up to $2 billion.

– Along with several other Chinese AI firms, SenseTime is on a U.S. blacklist which requires component makers to obtain official approval for any sales to it.

Editing by Una Galani and Katrina Hamlin