IMF worried about Middle East inflation, high rates, and oil prices

Although banks in the Middle East and Central Asia have very little exposure to the financial turmoil that occurred in the United States and Europe last month, a top IMF official said on Saturday that financial pressures are adding to the strains brought on by high interest rates, volatile oil prices, and years of double-digit inflation.

According to Jihad Azour, director of the IMF’s Middle East and Central Asia division, the stresses on the banking industry came on top of stricter monetary policies that increased interest rates and lowered availability to credit.

Azour claimed that there was a widening gap between those struggling nations and those with solid credit and access to markets, such as Morocco, Jordan, and oil exporting nations.

We are concerned because the matrix of threats keeps expanding, he said, including high interest rates, oil price volatility, geopolitical concerns, and the third consecutive year of double-digit inflation.

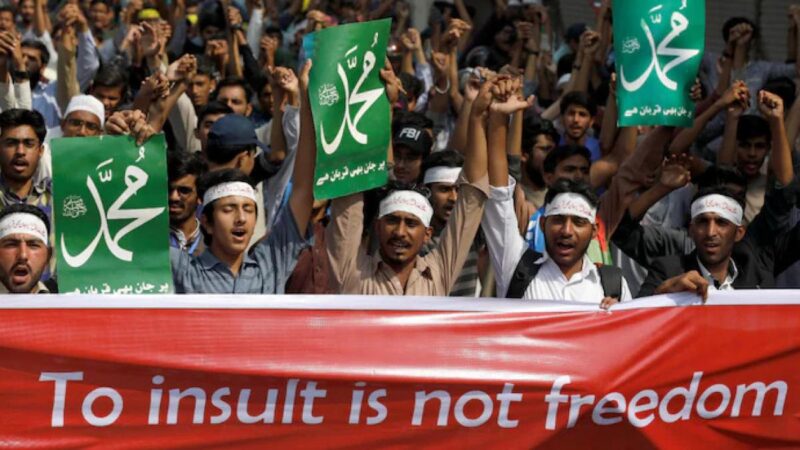

According to him, concerns about high debt levels, the possibility of social upheaval, and the ability to sustain strict regulations due to demands on the social front currently outweigh concerns about financial sector stability.

“We see vulnerabilities increasing again, and this is why countries are encouraged to do more structural reforms,” he added. “We need to increase growth by at least one or two percent.” And they have a window of opportunity since governments are now willing to take on more responsibility and refrain from funding central banks.

The Middle East and North Africa region’s GDP growth is expected to fall to 3.1% in 2023 from 5.3% this year, according to an estimate released by the IMF on Thursday.